Hello from FedInvent

The federal government’s letter-writing campaign with America’s academic institutions continues. The White House and Linda McMahon, Secretary of what remains of the Department of Education, sent a letter to nine universities and colleges, asking these institutions to sign the Compact for Academic Excellence in Higher Education.

The letter asked these institutions to agree to the following:

Freeze tuition for five years.

Limit undergraduate international students to 15% of enrollment.

Implement strict gender definitions — male, female, woman, man.

Provide free tuition to students studying math, biology, and other “hard sciences” if the school’s endowment exceeds $2M per undergraduate.

Applicants must take the SAT or a similar test, and the university must quell grade inflation.

Implement a Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance protocol.

The universities will receive “Multiple Positive Benefits:”

Access to student loans, grant programs, and federal contracts;

Funding for research directly or indirectly;

Approval of student and other visas in connection with university matriculation and instruction; and

Preferential treatment under the tax code.

The Compact Nine

The nine recipients of the letter are:

University of Arizona

Brown University

Dartmouth C. and Dartmouth Hitchcock Medical Center

Massachusetts Institute of Technology (MIT)

University of Pennsylvania

University of Southern California

University of Texas (UT Austin)

Vanderbilt U. and Vanderbilt U. Medical Center

University of Virginia

The recipients are a geographic and economic cross-section of higher education research and development (HERD) entities. Six private schools, three public schools. There are three Ivy League schools — Brown, Dartmouth, and the University of Pennsylvania. Three private universities — MIT, USC, and Vanderbilt; and three public universities — the University of Arizona, the University of Texas, and the University of Virginia. These are the Compact Nine.

The group of institutions covered by the original letter is a good size to examine the schools’ R&D spending, the proportion of that R&D spending funded by the federal government, and the innovation profile of these schools, including the number of patents they have received. We also did some back-of-the-envelope math on which schools would be offering free tuition to STEM majors, as well as the estimated cost of implementing the Bank Secrecy Act’s Know Your Customer compliance at the Compact Nine schools.

Compact Nine R&D Expenditures

To obtain the numbers on the R&D expenditures of the Compact Nine schools, we consulted our go-to source of information on R&D spending by higher education R&D (HERD) entities: the National Science Foundation’s annual HERD survey. The HERD Survey is an annual census of U.S. colleges and universities that expended at least $150,000 in separately accounted-for R&D in the fiscal year. The survey collects information on R&D expenditures by field of research and source of funds, and also gathers information on types of research, expenses, and headcounts of R&D personnel. The data we used is from the 2023 survey, the most recent available data.

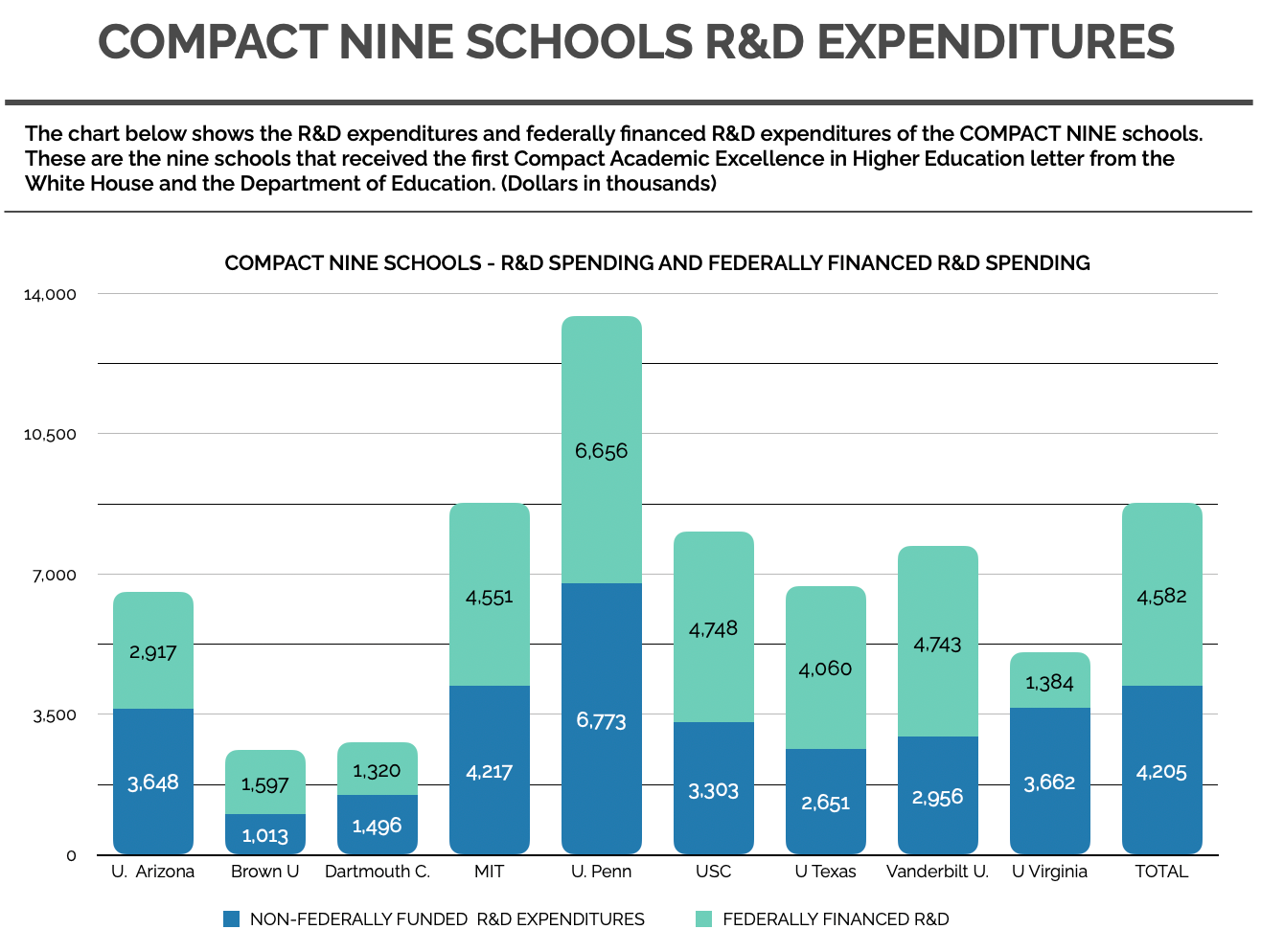

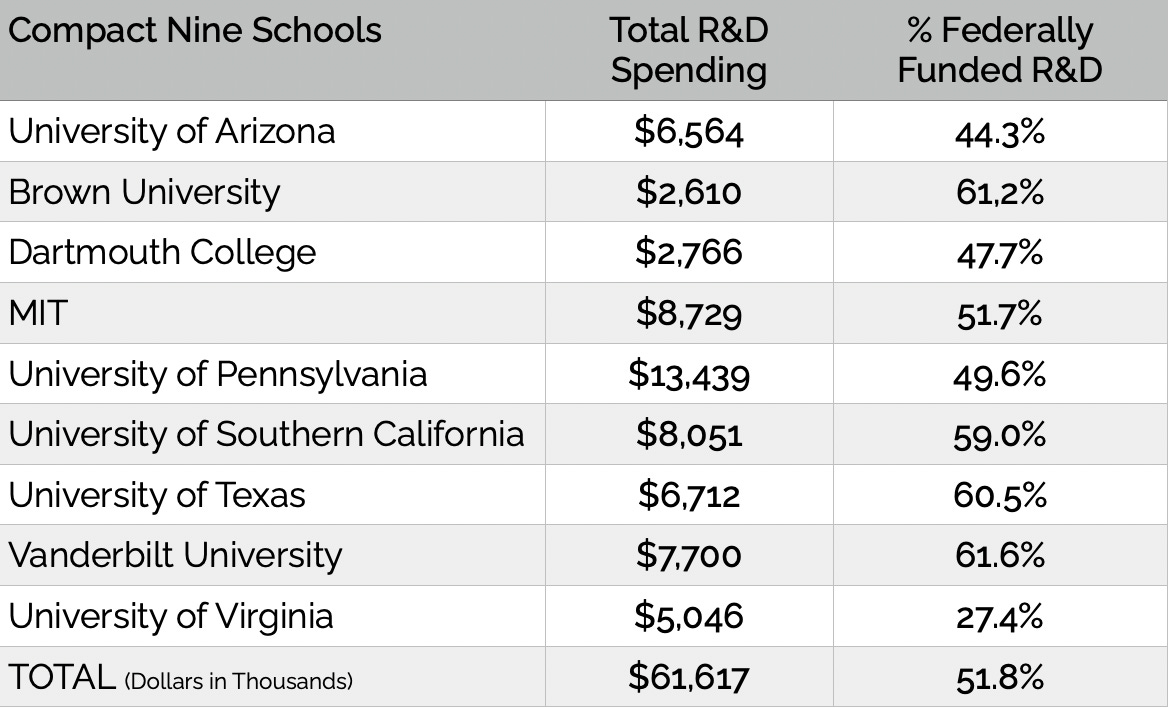

We examined the institutions’ total R&D expenditures and federally financed R&D expenditures. We analyzed the expenditure data from 2015 to 2023. The table below shows the non-federally funded R&D expenditures and the federally financed R&D expenditures.

The chart below shows the mix of R&D spending not funded by the taxpayer and federally funded R&D spending for each of the Compact Nine schools from 2015 to 2023.

The table that follows shows the percentage of each school’s R&D spending that is financed by the federal government.

(Data on the University of Texas system is reported by each individual school in the NSF HERD survey. We used the University of Texas at Austin data for this newsletter.)

The loss of federal financing for R&D will make a dent in the funding of the nine schools; however, all of the schools fund a significant portion of their R&D spending through sources other than the federal government alone.

The total R&D spending amount for all HERD institutions reported by the NSF from 2015 to 2023 is approximately $412 billion, totaling $412,007,193,000. The total spending of the COMPACT NINE schools was $61,617,000,000, 14.7% of total HERD R&D spending. The total federally funded R&D expenditures for the Compact Nine schools for the same time period is $4,582,355,000, approximately $4.5 billion, or 7.69% of all federally funded R&D spending.

The Innovation Pipeline Snapshot

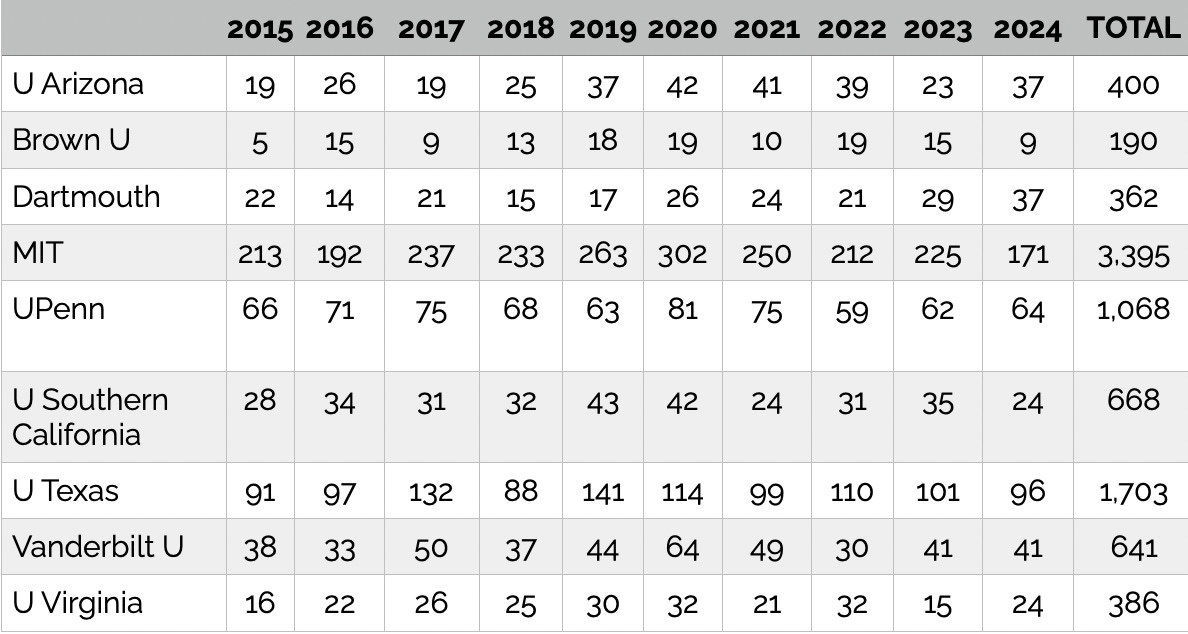

Since this is FedInvent, we examined the number of patents these schools have received. R&D spending precedes the issuance of patents. The count of patents from 2015 to 2024 provides a snapshot of the school’s inventions that were funded by the American taxpayer and the flow of patents from these schools. From 2015 to 2024, the Compact Nine schools received 8,813 patents.

(The University of Texas patent count reflects all patents assigned to the university, as the patents are all assigned to the same entity at the school.)

Free Tuition for Future Scientists? Only for a Select Few

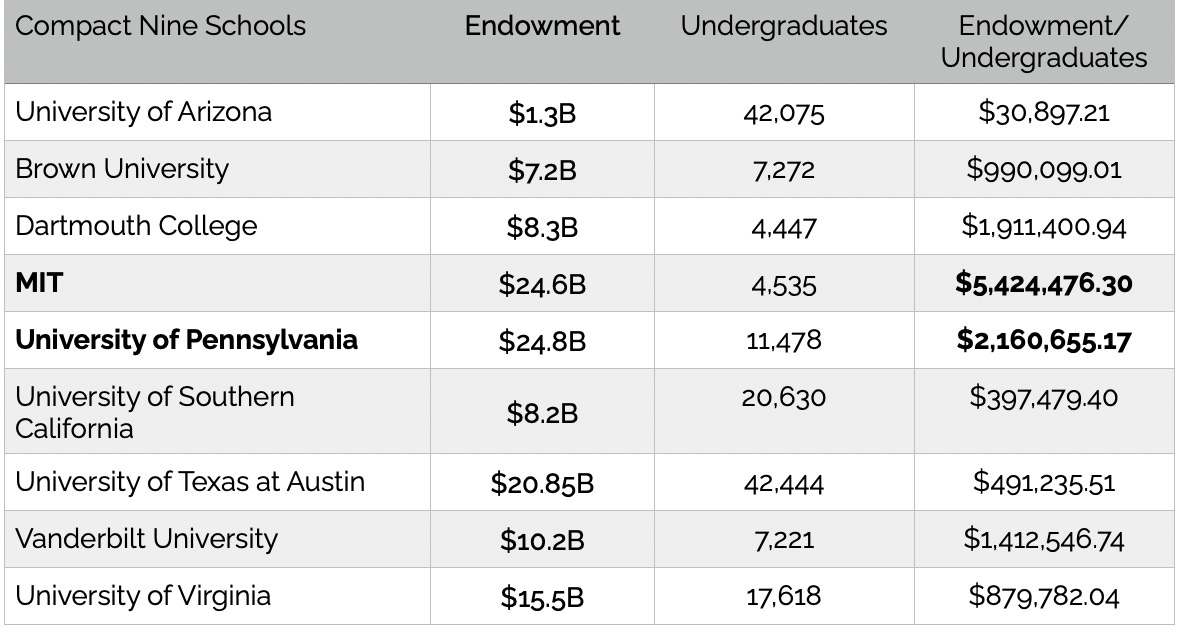

The Compact Nine letter asks universities to pay the tuition of undergraduate students majoring in “hard sciences” if their endowment exceeds $2 million per undergraduate student. Here is a quick look at which of the nine schools might be on the hook for offering free tuition to science majors.

The only two schools that appear to be in the $2 million per undergraduate zone, where signing the Compact agreement will lead to free tuition, are MIT and the University of Pennsylvania, with acceptance rates of 4.7% and 5.9%, respectively.

Before we move on to the Multiple Positive Benefits, we want to share some thoughts on the requirement that these schools implement KYC and AML procedures.

Know Your College Kid

In the section titled “Foreign Entanglements,” the letter outlines the requirement to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures for students, staff, and faculty at universities that sign the Compact. Implementing a compliant KYC and AML program is no small matter, and it won’t be cheap.

KYC/AML is a standard established for banks, financial institutions, insurance companies, and real estate brokers involved in high-end real estate transactions to monitor and report on the identity and activity of its account holders. It also requires banks to file Suspicious Activity Reports for transactions it believes might involve money laundering and other criminal activity. The letter calls for an “off-label” implementation of the Bank Secrecy Act for an academic audience of constituents. Congress never identified students and employees at American colleges and universities as targets of the program.

There are no metrics for the cost of implementing KYC at a college. The only available information is on the cost to banks. We derived the estimates by reviewing information on the Fenergo website. KYC provider Fenergo found that the average cost of a KYC review for a corporate client now stands at $2,598. Two-thirds of their survey respondents said a KYC review costs between $1,501 and $3,500.

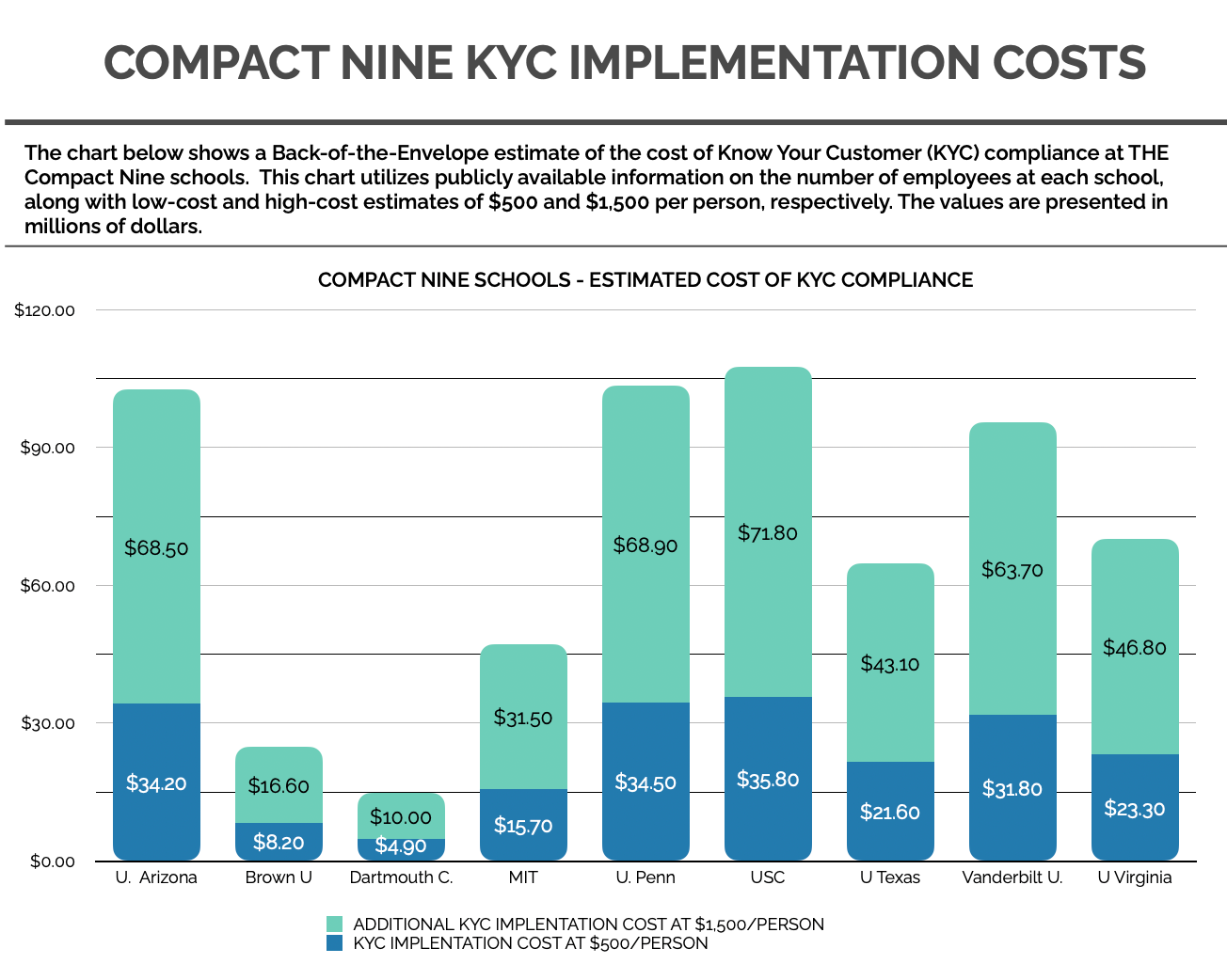

Here is a little FedInvent Back-of-the-Envelope math to estimate the cost of such a program. We assembled the publicly available number of employees at the Compact Nine schools. We then used a low-cost estimate of $500/person and a high-cost estimate of $1,500 per person to obtain a broad estimate of the potential cost of implementing KYC at a university.

Implementing a compliant KYC program at a university would have a high initial cost to certify all faculty, staff, and current students. This would be followed by an annual KYC onboarding cost as the new students arrive every semester. It is also unclear what events universities will need to track as potential indicators of suspicious activity. The Compact letter asks universities to freeze tuition. It doesn’t say to freeze fees. No doubt, the fee for the KYC review would be passed along to the students.

The fully loaded cost of attending Dartmouth College for a year — including tuition, fees, books and supplies, room and board, and personal expenses — is $91,312. Tuition and fees are $65,739. If tracking large transactions is the goal here, you are starting off with a $32,869 tuition check each semester. Vanderbilt’s total cost is $94,142. At the University of Virginia, the total cost is $44,180 for in-state students and $81,969 for out-of-state students. It’s unclear how money laundering could go on with tuition checks and other payments to the university. Pay the money in, withdraw before the deadline, and get a refund? Seems like a lot of work.

The Risk Profile of a College Student

One of the key aspects of the KYC regulation is for banks to establish a risk profile for clients opening accounts. The risk profile establishes the timeframe for the bank to reassess the risk of a particular entity with which the bank has a relationship.

What is the risk profile of a college student? College students typically don’t pay their bills themselves. The checks come from the parents of the students, from organizations providing scholarships, and from the university itself when it provides funding to the student. Will KYC compliance create a dragnet that sweeps in anyone paying tuition for their child, grandchild, niece, or nephew? How will agencies granting fellowships to undergraduate and graduate students work with university and KYC/AML compliance requirements?

Will a student's risk profile include tracking winnings from college online betting income? The NCAA found that sports wagering is pervasive among 18- to 22-year-olds, with 58% having engaged in at least one sports betting activity. Sports wagering activity is widespread on college campuses — 67% of students living on campus are bettors and tend to bet at a higher frequency. 41% of college students who bet on sports have placed a bet on their school’s teams, and 35% have used a student bookmaker. Do a student’s or a faculty member’s betting habits figure into the risk profile? What about the friend down the hall who is handling the bets? Will the school be responsible for tracking the base deposits? What is a money laundering event at a college?

Transforming a banking regulation into a financial tracking mechanism for university students, faculty, and staff is an untested process for universities to implement. Consider the cost to the University of California system. The UC system has over 299,000 students and 26,000 faculty members. Implementing KYC at $500/person could cost over $162.5 million.

Multiple Positive Benefits??

We’ll make this brief.

The four benefits offered by the government include:

Access to student loans, grant programs, and federal contracts;

Funding for research directly or indirectly;

Approval of student and other visas in connection with university matriculation and instruction; and

Preferential treatment under the tax code.

Is it the government’s intention to limit access to student loans to the schools that sign the compact?

Grant programs and federal contracts come under federal acquisition laws. These laws prohibit preferential treatment for entities bidding for grants and contracts. Should grants be going to organizations that signed the Compact or to the most qualified organization and team of researchers?

Funding for research, whether directly or indirectly, has the potential to limit government entities’ access to the best scientists and researchers at American universities. The Compact Nine schools all still have substantial R&D funding coming from sources other than the federal government. If the universities actively expand those relationships and stop seeking federal grants, how will the government handle its national security needs? If DOD wants the best materials for its stealth bombers and warfighter combat medicine improvements, it needs our universities. Similarly, DOE and the NSA, if they wish to pursue quantum computing and nanotechnology, having our most talented university scientists is probably a good idea.

On the visa front, with a cap on enrollment for foreign students at no more than 15% of the undergraduate student population, it appears that DHS and the State Department are beneficiaries here. They will have to process fewer visas and track fewer foreign students. There’s also an interesting but important twist here. This applies to undergraduates, not to graduate students. 28.8% of MIT’s student population is international students. There were 3,430 international students enrolled in degree programs at MIT in the 2024–2025 academic year: 530 undergraduates (12%) and 2,900 graduate students (40%). MIT could actually increase the number of international students by increasing the number of international undergraduate students.

Finally, preferential treatment under the tax code. We asked our tax experts for their thoughts. The universal response was, “Good luck with that.” Unless the government changes the tax code, there is no preferential treatment for universities beyond that already included in the code. They also added, “These guys can’t even keep the government open and fired the people at the IRS who can answer tax questions, how is the government going to get around to this?”

As always, thank you for reading FedInvent.

If you have questions on the federal innovation ecosphere, please send them to info@wayfinder.digital. We’ll add your questions to our plans for future newsletters.

Please share your FedInvent newsletters with other innovation enthusiasts. It will help us get the word out about our work.

The FedInvent Team

FedInvent tells the stories of inventors, investigators, and innovators. Wayfinder Digital’s FedInvent Project tracks the federal innovation ecosphere, taxpayer funding, and the inventions it supports. FedInvent is a work in progress. Please reach out if you have questions or suggestions. You can reach us at info@wayfinder.digital.