Hello from FedInvent,

The 2021 numbers are in. FedInvent has identified 7,724 taxpayer-funded patents granted in 2021.

In 2021 IBM received 8,682 US patents, including 138 with taxpayer funding. Samsung, the number two recipient, received 8,517. LG received 4,388 patents.

If you count all patents receiving taxpayer funding as one portfolio, FedInvent taxpayer-funded patents will rank third on the list of entities receiving the most US patents.

Back to 2022.

On Tuesday, February 8, 2022, the US Patent and Trademark Office (USPTO) issued 5,764 patents. One hundred six (106) of these patents benefitted from taxpayer funding.

In 2022 so far, USPTO has granted 36,616 patents. Six hundred ninety-six (696) had taxpayer funding.

The FedInvent Report for the 106 FedInvent portfolio patents is here. If you prefer to browse the patents by the federal department that funded the research, start here.

This week we departed from our usual analysis to look at how FedInvent Patents compare with all of the patents granted by USPTO.

Better, Faster, Cheaper, Smaller

As a rule, patented inventions are about better, faster, cheaper, and smaller things. Better clean energy solutions and cancer treatments. Faster networks and means of production. Cheaper robots and DNA sequencing. Smaller satellites and sensors. The market drives patents in the real world. Patents in the federal innovation ecosphere are driven by public policy. In both domains, the goal is economic growth.

Patents in the real world and patents in the federal innovation ecosphere are different. Getting patents in the real world is driven by the need to protect inventions so the innovation it spurs can make its way to the marketplace. Big companies fund R&D to remain competitive and grow their companies. Small inventors seek patents to cover the idea that will launch a new enterprise. Inventors and the entities they work for aim to commercialize their inventions to create new markets and new jobs. Economic growth ensues.

Getting patents in the federal innovation ecosphere is driven by federal science and technology policymakers and the funding decisions at the agency level. Policy-driven innovation is driven by the Broad Agency Announcements (BAAs) and the Funding Opportunity Announcements (FOAs) published on government websites. The BAAs ad FOAs describe the areas of interest for R&D that an agency wants to fund — biomedical engineering, biotechnology, quantum-enabled sensing and metrology, models of social dynamics, armor materials, all things batteries, precision measurement technologies, and more.

These BAAs and FOAs are the scientific and technical equivalent of the Bat Signal. Light up the federal R&D Bat Signal, project agency priorities and requirements, and the scientists and researchers will come. (Assuming the people with good ideas know where to look in the first place.)

Federally funded R&D is expected to follow a similar trajectory as real-world patent practices with a couple of deviations. Researchers and Principal Investigators and their team of professional grant writers create responsive proposals that map to the BAA or FOA areas of interest. With luck, or more likely because of previous experience doing work the funder, the team gets federal funding, aka free money. Then the team gets to work and makes discoveries.

Next? Send an invention disclosure to the agency that provided the money to tell the agency about the discovery. Write a patent application. Then the patent quest begins. Next? Send an invention disclosure to the agency that provided the money to tell the agency about the discovery. Write a patent application. Get a patent. Create a product. Figure out where to manufacture your product in the US. Products protected by taxpayer-funded patents are supposed to be manufactured in the US. Economic growth in the United States ensues.

Unlike the big US patent owners like IBM, Intel, and Raytheon, whose annual patent gambit shows up on annual leaderboard lists of the most prolific patent recipients, taxpayer-funded patents are everywhere. FedInvent patents are buried in hundreds of patent portfolios, including IBM's, Intel's, Raytheon's, and hundreds of colleges and universities. FedInvent is working on figuring out where all of these taxpayer-funded patents are.

Most of the current reporting on federally-funded patents is retrospective, seriously retrospective. The National Institute of Standards 2021 report, "Federal Laboratory Technology Transfer, Fiscal Year 2017, Summary Report to the President and the Congress," dated August of 2021, uses 2017 data. Three months later, the report was released to the public. NIST's "annual report" usually looks back at least three years. Using that approach, we'll be reading about COVID-19 inventions and patents filed in 2021 and 2022 in 2024 and 2025. Not helpful.

This information gap is one of the reasons we launched the FedInvent Project. American innovation is too important. Information about inventions and patents is too hard to find. Finding out about government patent activity in a 2021 report that uses 2017 data means the inventions they describe were probably filed around 2015 or, if a provisional patent application was filed, circa 2014. That doesn't work.

So FedInvent compiled a comprehensive database of taxpayer-funded patents and patent applications for 2021 and year-to-date for 2022. (Earlier years to follow.) We've assembled every federally-funded patent we can find in one place.

Number Three

FedInvent has identified 7,724 taxpayer-funded patents granted in 2021. In 2021 IBM received 8,682 US patents, including 138 with taxpayer funding. Samsung, the number two recipient, received 8,517. LG received 4,388 patents. If you count all patents receiving taxpayer funding as one portfolio, FedInvent taxpayer-funded patents will rank third on the list of entities receiving the most US patents.

The Public Policy-Driven Pieces of the Pie

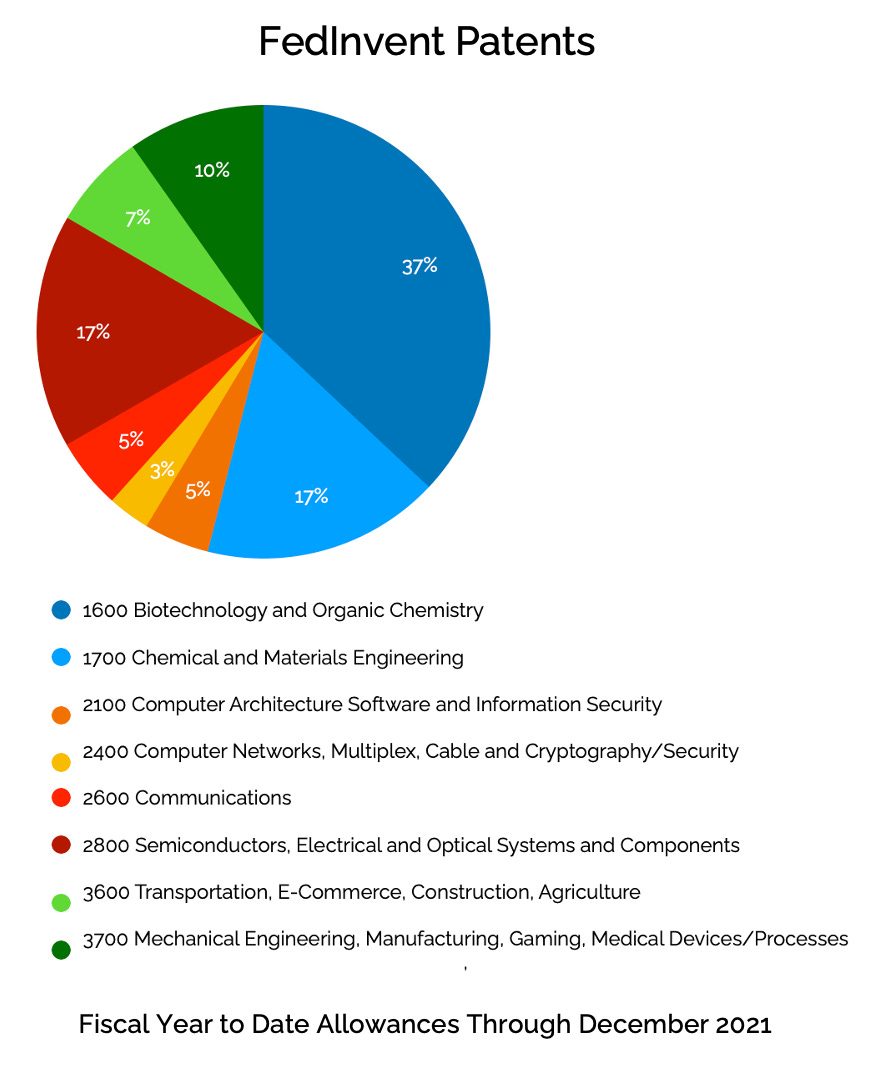

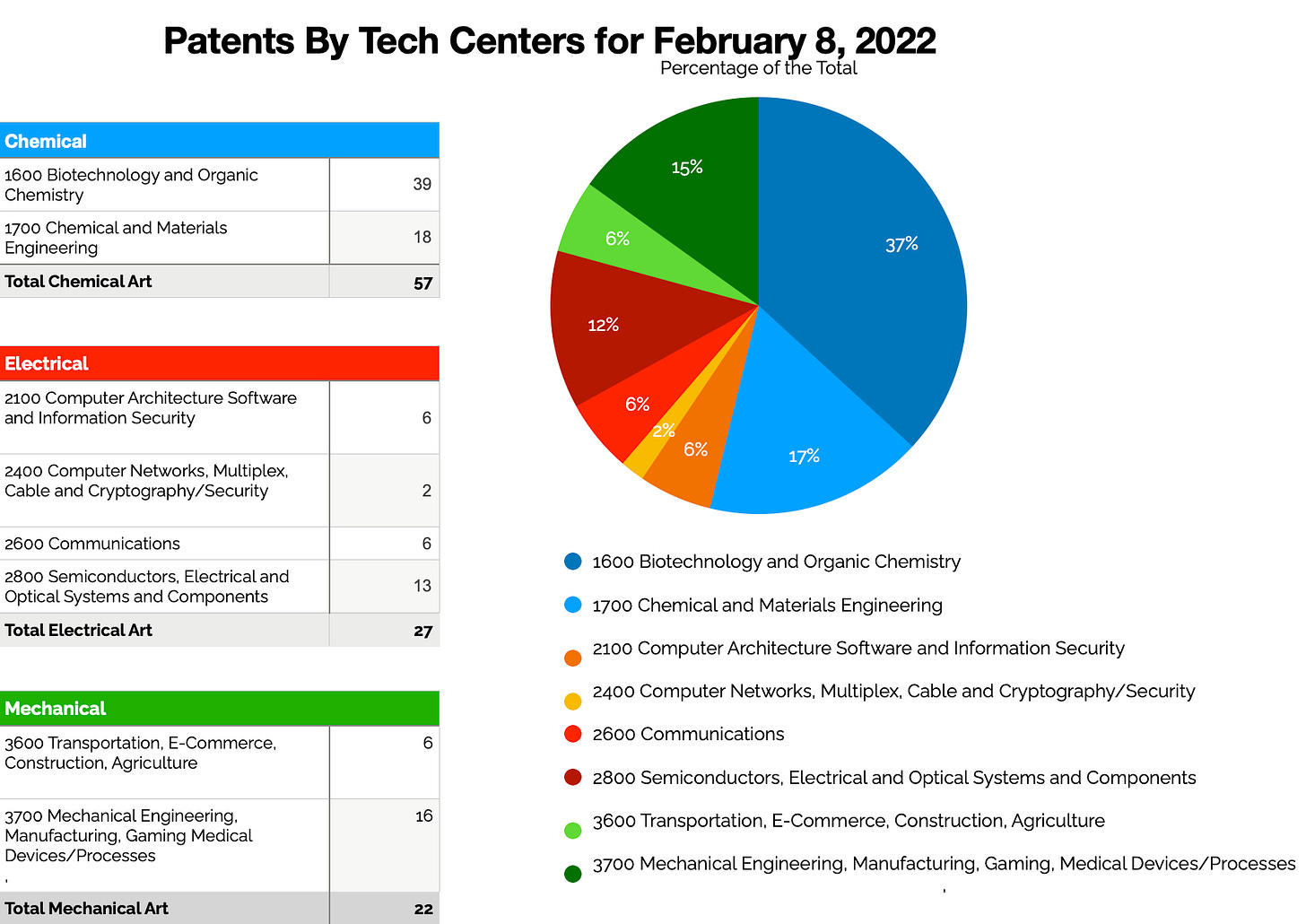

This week we used the USPTO Data Visualization website and the Office's dashboard to look at statistics on allowances by Technology Center. Tech Center data is one of the few one-to-one pieces of data that links a patent to a broad technology category. A patent is assigned to one Technology Center.

We downloaded the USPTO's year-to-date Tech Center allowance rates for the Government Fiscal Year 2022 and compared it to the taxpayer-funded patents in the FedInvent portfolio. The data covers the first three months of the 2022 government fiscal year — October, November, and December 2021. Next, we created a series of pie charts that compare the FedInvent allowance data and the overall allowance data. The charts that follow show what we found.

USPTO Allowance Rate By Technology Center

The first table below is the Allowance Rate by Technology Center for all patents.

FedInvent Allowance Rate By Technology Center

The second table is the Allowance Rate By Technology Center for FedInvent portfolio patents for the same period.

The Big Three

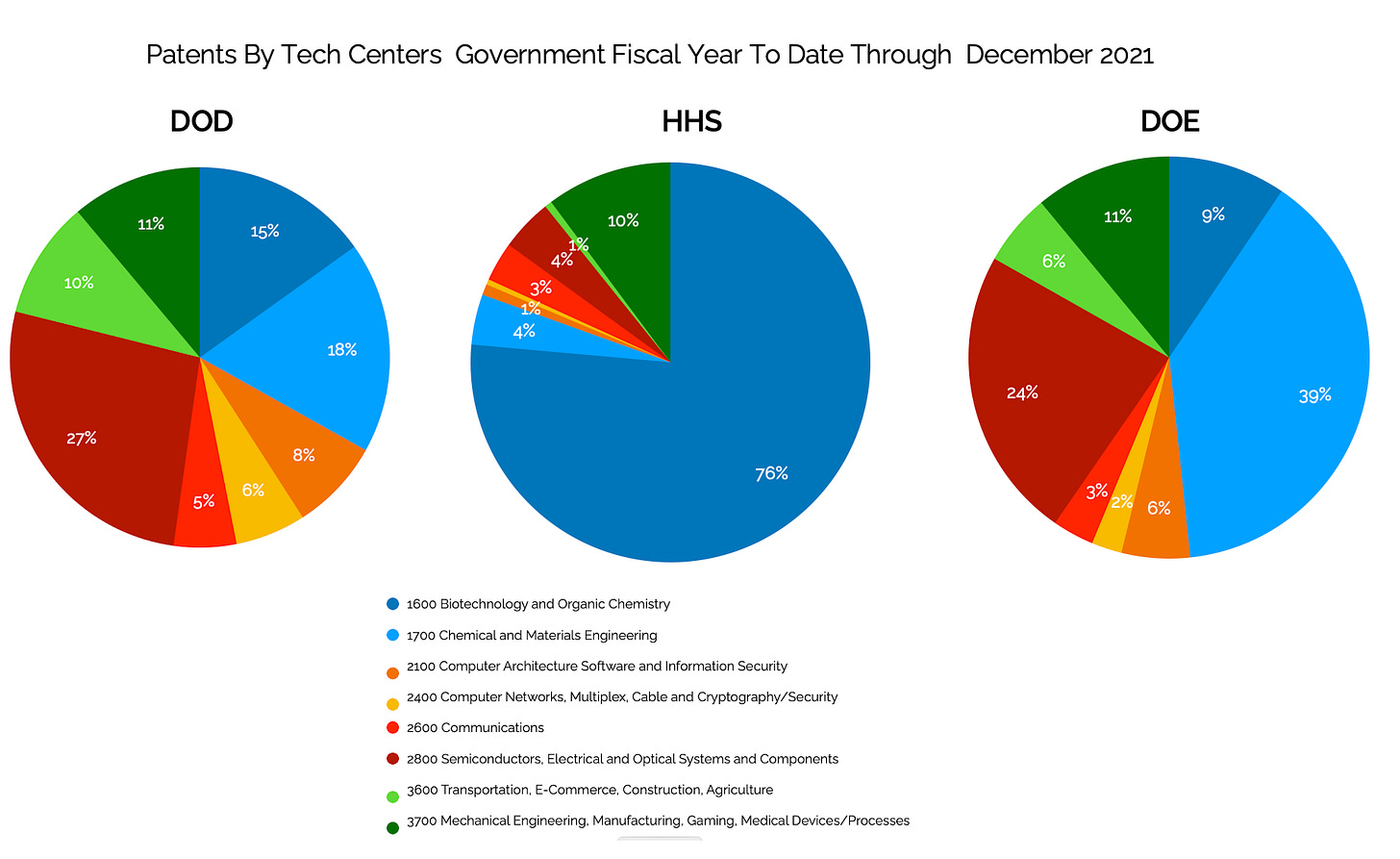

We took a look at the big three departments — Department of Health and Human Services (HHS), Department of Defense (DOD), and the Department of Energy (DOE) to see how the patents they funded were distributed across the Tech Centers. The charts below show all three agencies side by side.

A caveat. The one-to-one patent to Technology Center data starts to get a little loose when you look at HHS, DOD, and DOE here. Many of the patents we looked at had a single funding source within a single department. Others patents had funding from more than one source. For example, an inventor funded by the National Cancer Institute, part of HHS, may also have received funding from the United States Army Medical Research and Development Command, part of DOD. Both entities are in the government interest statement, so FedInvent classifies the patent as funded by HHS and DOD.

DOD's numbers reflect patents we could definitively assign as funded by DOD. Most of the Bayh-Dole scofflaws are defense contractors that don't provide complete data in their government interest statement. DOD patents are undercounted.

HHS's allowance numbers look like what was expected. Medical inventions (1600) and a nice chunk of medical device inventions (3700) from HHS and its patent behemoth.

DOE's sweet spot is chemical and materials engineering — biofuels, synthetic biology, and additive manufacturing and materials for enhancing the performance of batteries. The solar inventions live in both Tech Center 1700 and 2800.

On to this week's patents.

Bayh-Dole Scofflaws

There are two Bayh-Dole scofflaws in Tuesday's taxpayer-funded patents. The first patent is US patent 11242761, "Tangential Rotor Blade Slot Spacer for a Gas Turbine Engine," brought to you by Raytheon. (Things are back to normal.).

US patent 11243955, "Latent Token Representations for Passage and Answer Scoring in Question Answering Systems," is assigned to IBM. It is the work of the team from IBM's Watson Research group. Some of the engineers have moved on. IBM Watson developer Stephen Boxwell is now at Battelle. Kristen Summers is now at Microsoft was a Business Unit CTO. Her job title screams, "I work for the Intelligence Community."

Patents By the Numbers

On Tuesday, February 8, 2022, the US Patent and Trademark Office (USPTO) issued 5,764 patents. One hundred six (106) of these patents benefitted from taxpayer funding. Here is how they break down.

One hundred three (103) patents have Government Interest Statements.

Eighteen (18) have a government agency as an applicant or an assignee.

A federal department is the only assignee on nine (9) patents.

The 106 new patents have 124 department-level funding citations.

These patents are the work of 399 inventors.

The 372 American inventors come from 37 states and the District of Columbia.

The 27 foreign inventors come from 13 countries.

There are 67 patents (63%) where at least one assignee is a college or university, the HERD.

Six patents (6) resulted from the collaboration between two universities.

Federally Funded Research and Development Centers (FFRDCs) received three (3) patents.

Five (5) patents were assigned Y CPC symbols indicating that the invention may be useful in mitigating the impact of climate change.

The Big Three States — Win, Place, and Show

The usual suspects are in the Win and Place positions. This week's patent Show position goes to Pennsylvania.

California has 19 first-named inventors and 75 total inventors.

Massachusetts has ten first-named inventors and 42 total inventors.

Pennsylvania has nine first-named inventors and 29 total inventors.

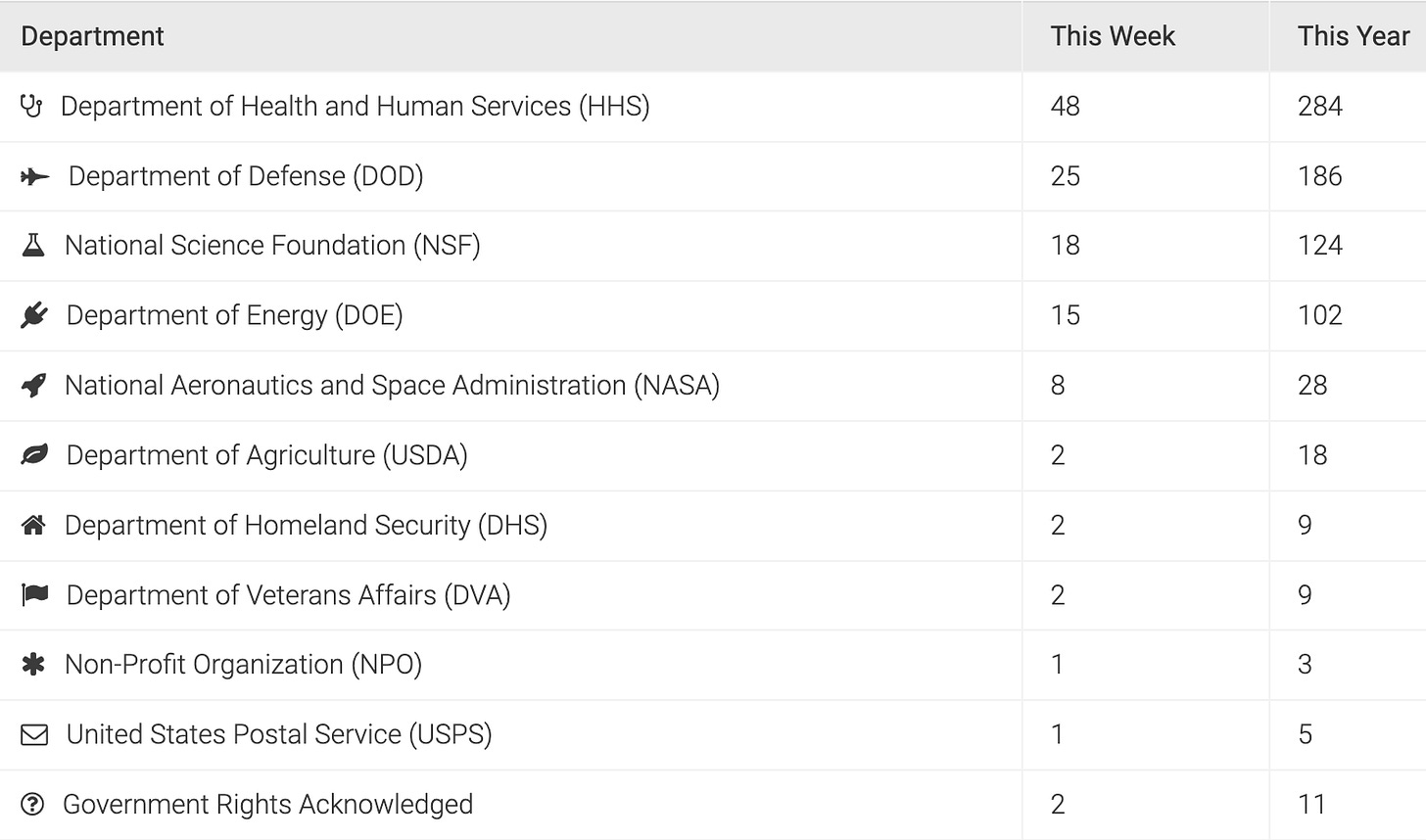

Patent Count By Department

Count By Technology Center

The Health Complex

The table below shows this week's count of the number of funding citations where the recipient cites the Department of Health and Human Services (HHS), the institutes at the National Institutes of Health, and other subagencies that are part of HHS, the Health Complex.

The Health Complex Year-To-Date

The table below is the 2022 year-to-date count for entities FedInvent classifies as part of the Health Complex.

Before We Go

Federally Funded Research and Development Centers (FFRDCs) — This week we are starting to roll out improved identification of federally funded research and development centers. You'll see that data on the details page.

If you aren't a paid subscriber yet, please consider subscribing. It will help us keep going in 2022. Please share FedInvent with other innovation enthusiasts. We are trying to get the word out.

As always, thank you for reading FedInvent.

The FedInvent Team

FedInvent tells the stories of inventors, investigators, and innovators. Wayfinder Digital's FedInvent Project follows the federal innovation ecosphere, taxpayer money, and the inventions it pays for. FedInvent is a work in progress. Please reach out if you have questions or suggestions. You can reach us at info@wayfinder.digital.